Value Added Tax (or VAT) is an indirect tax. Occasionally you might also see it referred to as a type of general consumption tax. In a country which has a VAT, it is imposed on most supplies of goods and services that are bought and sold.

VAT is one of the most common types of consumption tax found around the world. Over 150 countries have implemented VAT (or its equivalent, Goods and Services Tax), including all 29 European Union (EU) members, Canada, New Zealand, Australia, Singapore and Malaysia.

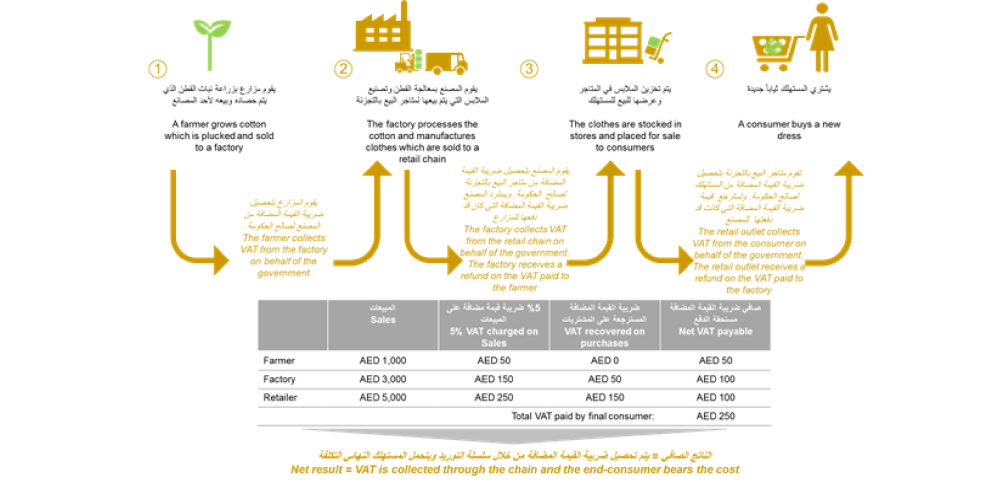

VAT is charged at each step of the ‘supply chain’. Ultimate consumers generally bear the VAT cost while Businesses collect and account for the tax, in a way acting as a tax collector on behalf of the government.

A business pays the government the tax that it collects from the customers while it may also receive a refund from the government on tax that it has paid to its suppliers. The net result is that tax receipts to government reflect the ‘value add’ throughout the supply chain. To explain how VAT works we have provided a simple, illustrative example below (based on a VAT rate of 5%):

As per the GCC Supreme Council resolution, VAT [in the UAE] will be implemented as of January 1, 2018. – Obaid Humaid Al Tayer, UAE Minister of State for Financial Affairs

The area of sectors where this mechanism can be taken to action is broader and it includes also mobile pones, integrated circuit devices, supply of gas and electricity, telecom services, game consoles, tablet PCs and laptops, cereals and industrial crops and raw and semi-finished materials.

As a seller on the market you are responsable to pay the buyers VAT based in their own country (this means any EU country) nevertheless whether you are an EU based company or not. This new directives are not quantitiy and price aware so by selling one ítem for less than a dollar, new legislature will rules are still being applied.

You are also obliged to store buyers information (their location etc.) for the next 10 years after the deal was executed.