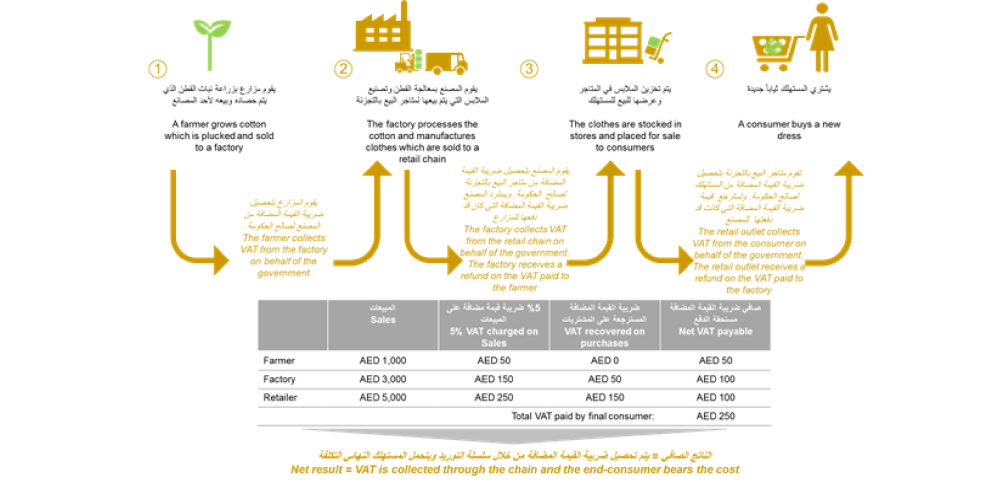

Explaining VAT

Value-Added Tax or VAT is a tax on the consumption or use of goods and services levied at the point of sale. VAT is a form of indirect tax and is used in more than 180 countries around the world....

Read more

Value Added Tax (or VAT) is an indirect tax. Occasionally you might also see it referred to as a type of general consumption tax. In a country which has a VAT, it is imposed on most supplies of goods and…

All businesses in the UAE will need to record their financial transactions and ensure that their financial records are accurate and up to date. Businesses that meet the minimum annual turnover requirement (as evidenced by their financial records) will be…

Concerned businesses will have time to prepare before VAT will come into effect. During that time, businesses will need to meet requirements to fulfil their tax obligations.